Carry.com Solo 401k Review: The 2025 Approach

Carry.com's Solo 401k eliminates retirement planning headaches for entrepreneurs. What makes it so different?

John Angelo Yap

Updated November 11, 2025

A man bringing his assets to Carry, generated with Midjourney

Reading Time: 8 minutes

Running a solo business means wearing every hat imaginable. Between client work, marketing, and actually trying to build something sustainable, retirement planning usually falls to the bottom of the list. We get it – when you're focused on making payroll (even if it's just your own), maxing out a 401k feels like a luxury problem.

But here's the thing: as solo entrepreneurs, we actually have access to one of the most powerful retirement vehicles available – the Solo 401k. The problem? Most providers make it feel like you need a finance degree and endless patience to set one up. We've tried a few over the years, and the paperwork, confusing interfaces, and dated systems always left us wondering if there was a better way.

Then we found Carry. And we're pretty convinced this is what Solo 401k platforms should have been all along. It's not perfect, but it's the first one that actually feels like it was built for people who run modern businesses, not for corporate HR departments stuck in 1995.

If you're self-employed or running a solo business, chances are you've looked into setting up a Solo 401k. It's one of the most powerful retirement tools available for individuals without full-time employees.

What Is Carry?

Carry is what happens when someone finally asks 'why does setting up a Solo 401k feel harder than actually running my business?' They're a platform built specifically for business owners, freelancers, and independent professionals who want the tax advantages without the administrative nightmare.

What caught our attention initially was how they actually seemed to understand the modern world. No faxing documents. No mailing paper forms to some processing center in Nebraska. No waiting weeks for account approval. Everything from onboarding to managing your investments happens online, the way it should in 2025. Their interface genuinely feels like it was designed this decade, which honestly shouldn't be revolutionary, but in the world of retirement accounts, it absolutely is.

In this article, we’ll focus solely on Carry’s Solo 401k offering.

Core Features of Carry’s Solo 401k

Here’s what Carry includes with its Solo 401k plan:

Roth, Pre-Tax, or Both

Carry allows contributions to a Roth Solo 401k (after-tax), a traditional Pre-Tax Solo 401k, or a combination of both. This gives users flexibility when it comes to tax planning. You can lower your taxable income today using pre-tax contributions or pay taxes upfront and enjoy tax-free withdrawals in retirement via Roth.

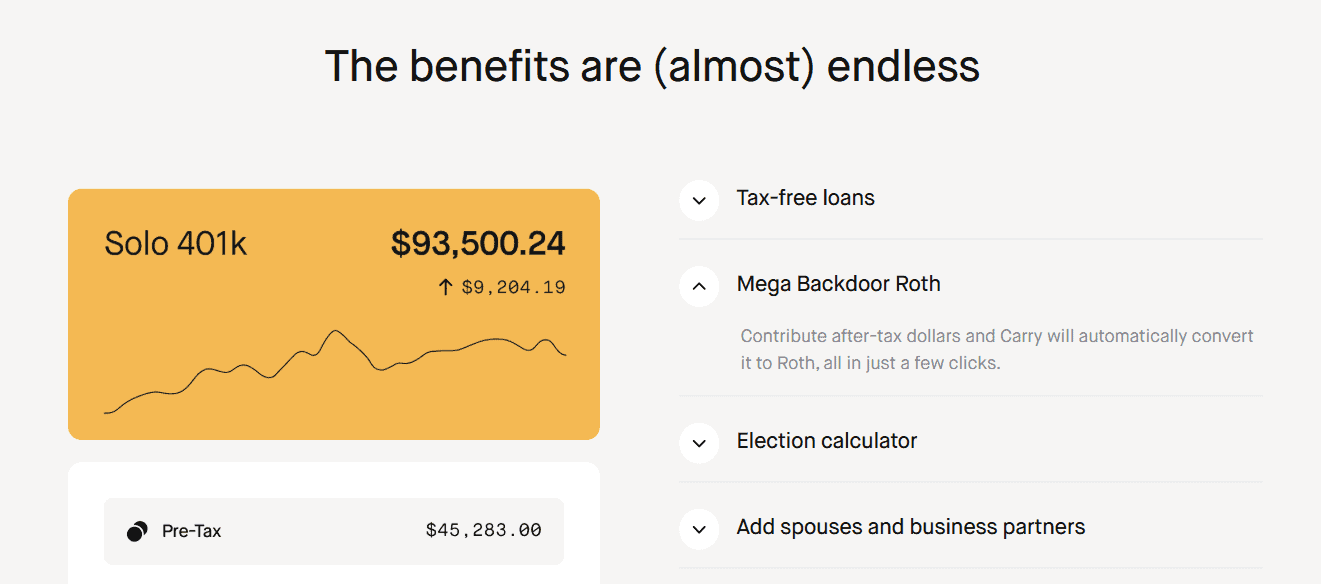

Mega Backdoor Roth Support

If you're already maxing out your Roth IRA and thinking 'I wish I could put MORE into tax-free growth,' Carry's got you covered. They support after-tax contributions with automatic conversion to Roth – the Mega Backdoor Roth strategy that high earners dream about but most providers make unnecessarily complicated.

Setting this up with traditional providers usually involves multiple manual steps and hoping you timed everything correctly. Carry automates the whole thing. You contribute after-tax dollars above the normal limits, and they handle the conversion.

Tax-Free Loan Capability

Carry permits loans from your 401k—up to 50% of your vested balance or $50,000, whichever is lower—without early withdrawal penalties, in accordance with IRS rules. This can be helpful for short-term cash flow needs without sacrificing your long-term financial plan.

Spouse and Partner Support

You can add your spouse or a business partner to the same plan. Each person will need their own Carry account, but the overall plan accommodates them without requiring a completely separate Solo 401k setup. This is ideal for family businesses or co-owned consultancies.

Integrated Election Calculator

Before setting up your plan, you can use Carry’s contribution calculator to estimate how much you can put away each year. This tool aids in planning, especially for those aiming to front-load retirement contributions or maximize annual limits.

EACA Tax Credit Eligibility

Carry supports plans eligible for the $1,500 Eligible Automatic Contribution Arrangement (EACA) credit, which some users may qualify for depending on setup. This lesser-known incentive can help offset initial plan costs.

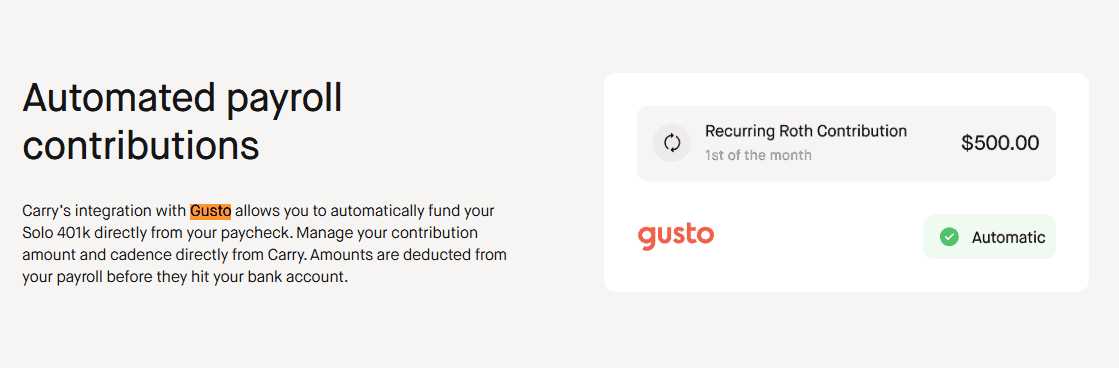

Payroll Integration with Gusto

If you use Gusto for payroll, Carry allows you to automate contributions directly from your paycheck. It ensures consistency and accuracy while reducing the administrative burden that often comes with Solo 401k contributions.

Investment Options

With Carry’s Solo 401k, can you invest in:

Traditional Assets: YES

You can invest in stocks, ETFs, and mutual funds—many of which include low-fee options from Vanguard and other well-known providers. Carry’s platform is custodian-agnostic and allows for diversified public market exposure.

Alternative Assets: YES

Carry also supports investing in private equity, real estate, and other alternative assets. This puts it in line with other modern Solo 401k providers that offer more than just basic index funds. Alternative investments can provide new return profiles and tax strategies for those with larger balances.

Crypto Access: YES (Via IRA)

You can invest in crypto—just not directly through the Solo 401k. Crypto support is available through Carry’s IRA product, which means you can still gain exposure to digital assets, but you’ll need to manage those holdings separately.

Roboadvisor Option: YES

Don’t want to manage your own portfolio? Carry offers a built-in roboadvisor that can manage your allocations for you. This is useful if you want exposure to the market but don’t want to spend time researching and rebalancing your own portfolio.

Rollover Support

If you already have an existing Solo 401k or IRA, Carry lets you roll that over into their platform. The rollover process is largely digital, and Carry provides step-by-step instructions.

You can also transfer eligible Traditional IRAs or older employer-sponsored 401ks into your Carry Solo 401k. This is useful if you’re consolidating multiple accounts and want better control over your retirement assets.

What You Can’t Do with Carry’s Solo 401k

No platform is perfect, and Carry has a few limitations:

- No mobile app (yet) – The site is mobile-friendly, but there’s currently no standalone app.

- Limited banking integrations – Besides Gusto, other payroll or bank integrations are not yet supported.

- Some features may require plan upgrades – Certain tools like roboadvisors and alternative asset investing require the Pro or VIP plans.

These may not be deal-breakers for most users, but they’re worth noting if you need more hands-on flexibility.

Pricing

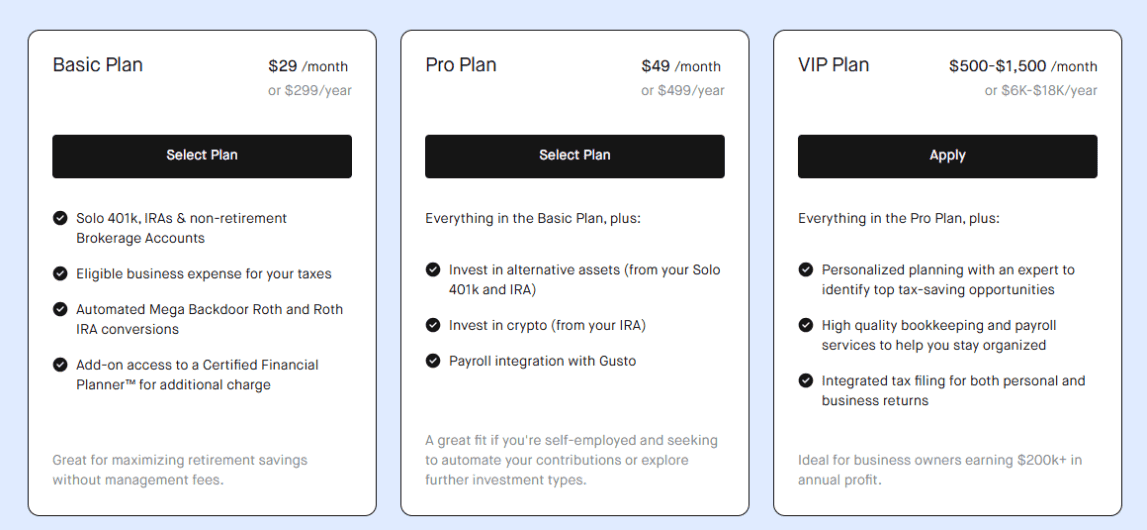

Carry’s pricing is now publicly available and comes in three tiers:

- Basic Plan – $29/month or $299/year: Includes Solo 401k, IRA, and brokerage account access. Mega Backdoor Roth automation is included, and you can optionally pay for Certified Financial Planner™ access.

- Pro Plan – $49/month or $499/year: Adds support for investing in alternative assets and crypto (via IRA), and integrates directly with Gusto for payroll.

- VIP Plan – $500–$1,500/month: Designed for high-income business owners ($200K+ in profit annually), this tier includes white-glove services like tax planning, integrated tax filing, bookkeeping, and personalized planning with a financial expert.

This tiered structure gives users flexibility depending on whether they need just the basics or a full-suite financial partner.

Who Is Carry Actually Made For?

Digital-first solopreneurs – If you run your entire business from Notion, Slack, and a laptop, you'll appreciate Carry's approach.

High-earning freelancers and consultants – Making $100K+? You should be maxing out retirement accounts for the tax benefits alone.

Anyone tired of legacy retirement platforms – If you've ever tried to set up a Solo 401k through a traditional provider and wanted to throw your computer out the window, Carry may feel like a breath of fresh air.

Gusto users with variable income – The Gusto integration alone makes this worth it if you're already on that platform.

Investors interested in alternatives – Want to diversify beyond stocks and bonds? Carry's Pro plan lets you invest in real estate funds, private equity, and other alternative assets inside your 401k. Most providers don't offer this.

Carry Compared To Others

| Provider | Annual Cost | Setup Fee | Roth | Mega Backdoor Roth | Alternative Assets | Loans | Best For |

|---|---|---|---|---|---|---|---|

| Carry | $299/yr (Core) $499/yr (Pro) | $0 | ✓ | ✓ | ✓ (Pro plan) | ✓ | Modern entrepreneurs who want automation + alternatives. Gusto users. |

| Rocket Dollar | $360/yr (Silver) $480/yr (Gold) | $360-$600 | ✓ | ✓ | ✓ | ✓ | DIY investors who want full checkbook control. Real estate focused. |

| Guideline | $588/yr + 0.15-0.35% AUM | $0 | ✓ | ✗ | ✗ | ✓ | Businesses with employees. Good payroll integration but fees scale with balance. |

| Fidelity | $0 | $0 | ✓ | ✗ | ✗ | ✗ | Budget-conscious investors. Basic features, stocks/funds only. Manual everything. |

| Vanguard (now Ascensus) | $20/fund + $20 custodial | $0 | ✓ | ✗ | ✗ | ✗ | Vanguard index fund fans. Low expense ratios but clunky interface. Fees add up. |

| Charles Schwab | $0 | $0 | ✓ | ✗ | ✗ | ✗ | Schwab customers. Wide asset access but public markets only. No advanced strategies. |

| E*TRADE | $0 | $0 | ✓ | ✗ | ✗ | ✓ | Active traders. Good research tools but limited to traditional brokerage investments. |

My Thoughts

Overall, Carry.com’s Solo 401k is a modern, flexible platform that packs in powerful features like Roth support, Mega Backdoor Roth automation, and payroll integration. Its user interface is clean, its investment options are broad, and it brings Solo 401ks into the 2025 era with tools that feel actually usable.

It’s not the only player in the space, but if you’re looking for an experience that balances tech-forward design with tax-advantaged firepower, Carry is definitely worth a closer look.

Just keep in mind that if you’re looking to invest in crypto directly through your Solo 401k or need a mobile app, you may want to consider alternatives—or wait to see if those features roll out in the near future.

Carry checks nearly every box for solo business owners serious about optimizing their retirement strategy.

Want to Learn Even More?

If you enjoyed this article, subscribe to our free newsletter where we share tips & tricks on how to use tech & AI to grow and optimize your business, career, and life.